Making payments more accessible to everyone

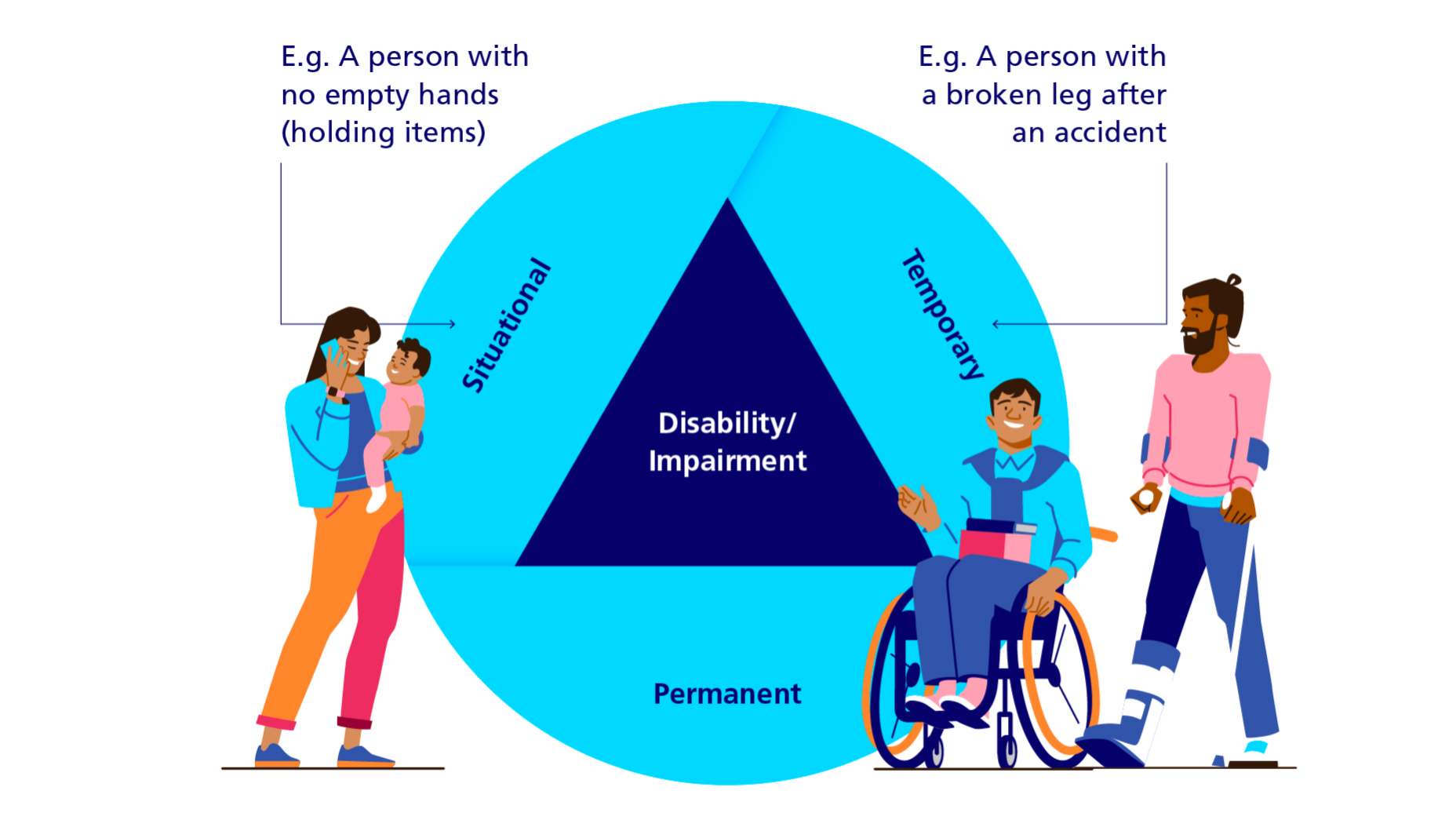

We believe payments should be accessible to everyone. Disabilities or impairments can affect anyone, at any time and can be permanent or temporary in nature. They can be defined as a mismatch between people’s abilities and their environment. Where this mismatch affects your customers’ ability to make payments, we feel that technology can step in to bridge that gap.

Our More Accessible Payments Initiative is dedicated to creating a barrier-free payment landscape. Beyond just tools and platforms which enable physical and digital payments, it embodies a social commitment, promoting co-creation, amplifying awareness, and rallying collective action to achieve an inclusive payment environment for all.

Understanding impairment

Accessibility is for everyone

More Accessible Payments - Embrace a more inclusive future

Why does accessibility matter for banks?

Customer and market awareness:

Leadership in payment

Customers are increasingly choosing brands that align with their values. Social and ethical responsibility will soon become some of the most important drivers in customer perceptions, acquisition and loyalty.

Marketing and brand commitment

- Raising brand awareness

- Fulfil ESG commitments

- Be inclusive

- Banking as a lifestyle

Fostering human-centric innovation:

New technologies create new opportunities

Designing solutions that are more human-centric and experience-orientated makes banks more competitive and attractive.

Trusted innovation

- Innovation and competitive edge

- Cybersecurity enhancements

- Interoperability and integration

- Universal design principles

Growing relationships:

Developing an accessible payments ecosystem

The soaring global trend towards solutions that embrace accessibility and inclusion, coupled with an increasing regulatory and legislative pressure, ensures that banks will need to build relationships and understanding across the wider payments market and beyond, so that they can maintain a competitive edge.

Sustainable growth strategy

- Expand customer base

- Attract like-minded customers

- Risk management

- Diversify revenue stream sustainable growth

The challenges for banks

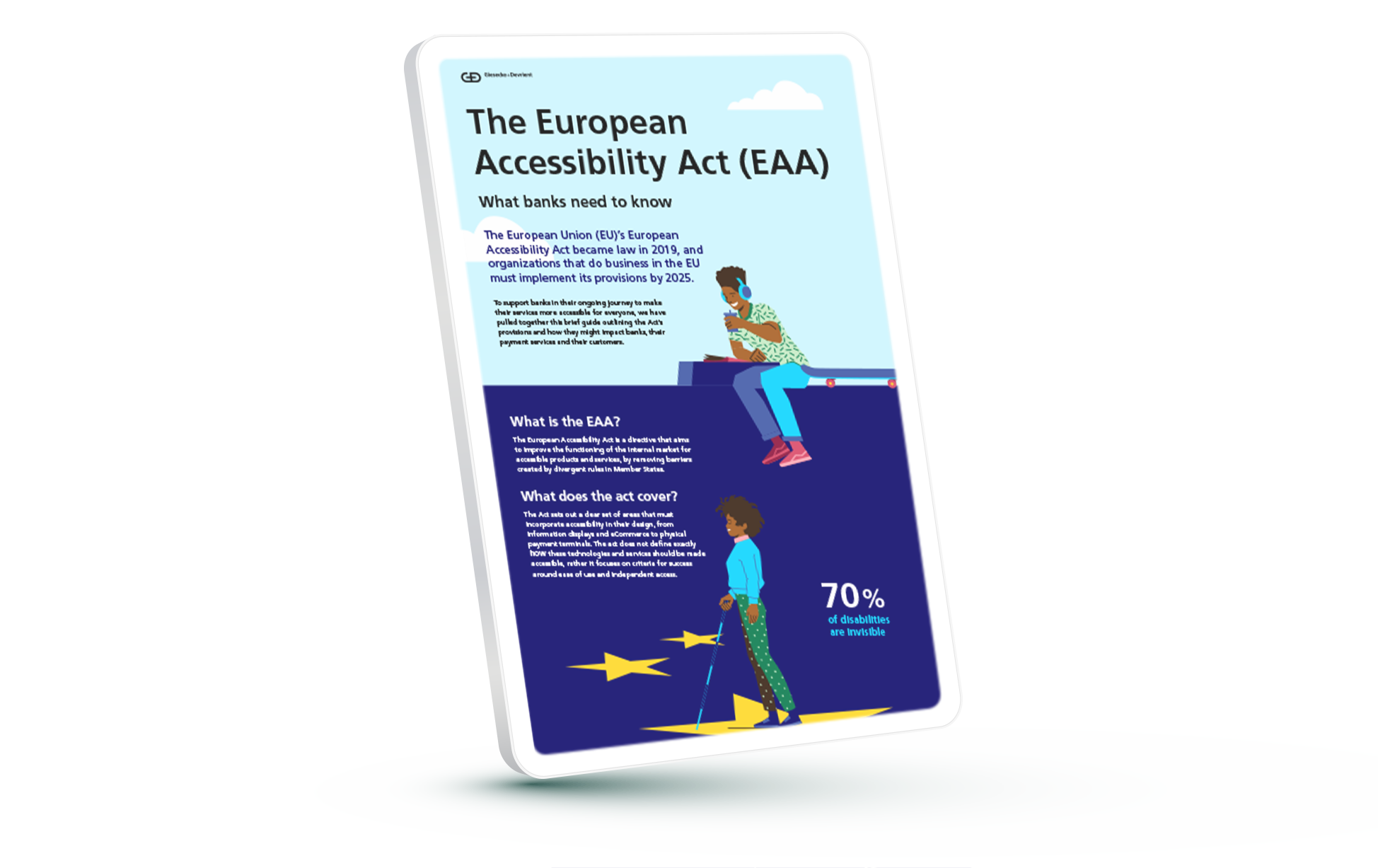

The European Accessibility Act (EAA) – what you need to know

Download our factsheet to learn more about how the EAA will impact operations in Europe, and its effects on every part of the payments journey.

How can G+D help?

Supporting banks in their social and eco-sustainable payment journeys

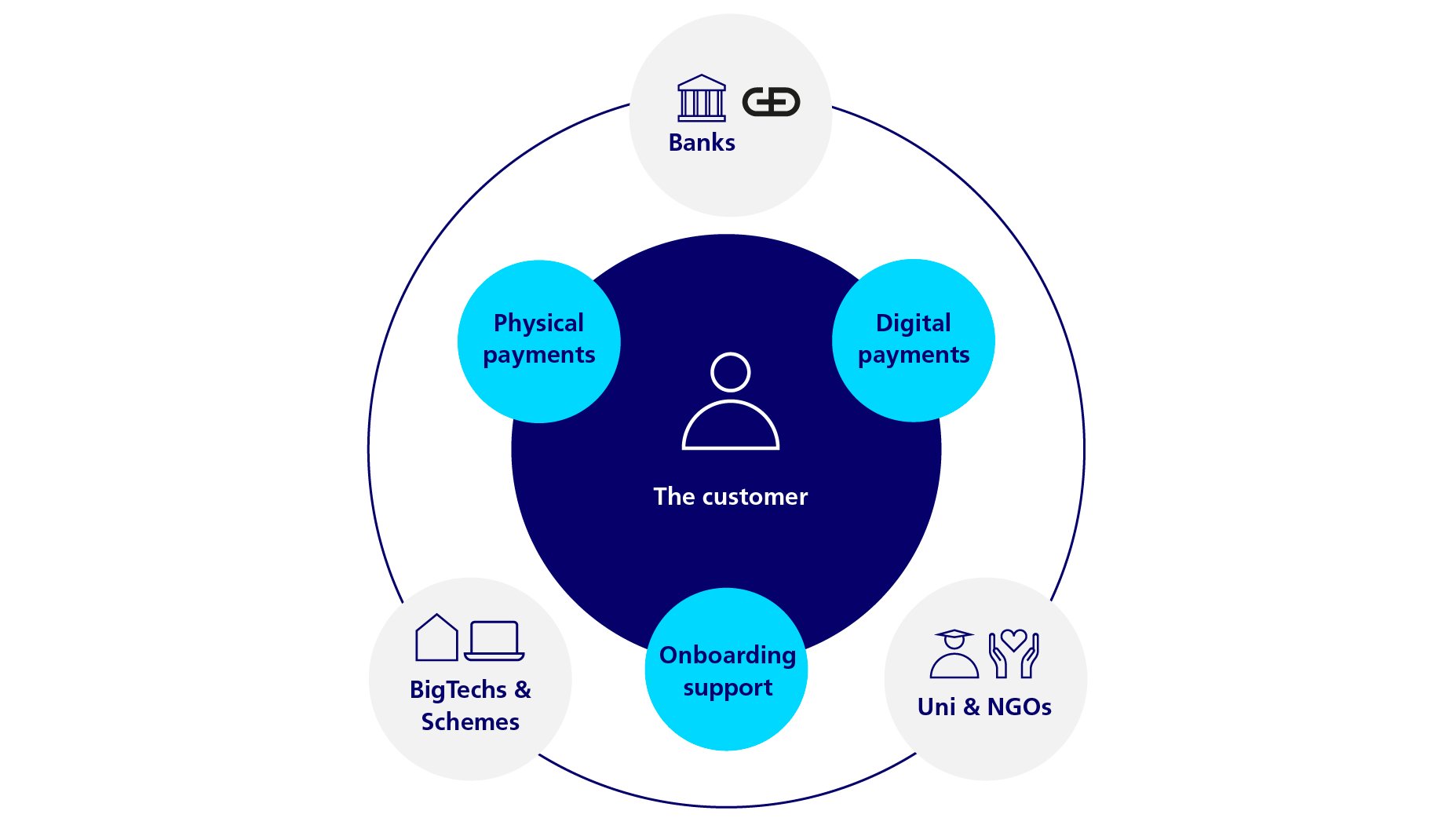

The payments industry is only at the beginning of the journey toward achieving their social commitments and increasing accessibility for all. We have committed to supporting banks on their journeys – one step at a time. We work with, banks, retailers, civic organizations and end customers to ensure that everyone can access payments, no matter the level of support that people need.

Accessibility principles for inclusive payment solutions

Together from the start

We believe that true change can only happen when we involve the accessible community from the inception of each project.

Accessibility is for everyone

When designing for inclusivity, any potential solution should be universally useful, accessible for everyone, and made available to all.

Begin now and grow with every step

The most important step of any journey is the first one. Instead of waiting for some ‘perfect’ set of solutions, begin with whatever resources you have at hand.

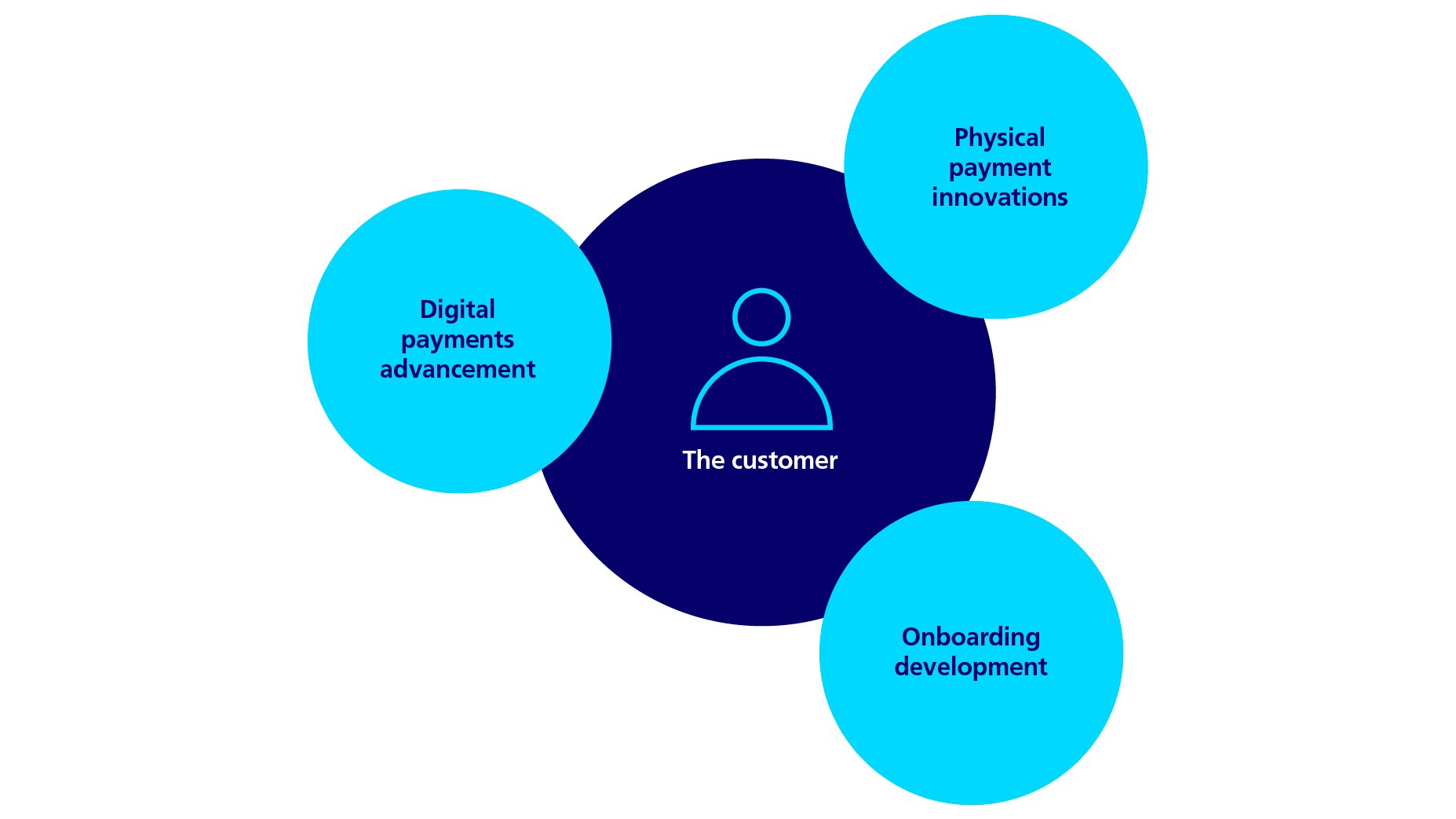

The More Accessible Payment solution suite

Physical payment innovations

Focusing on more accessible and inclusive card solutions, from notches, large print, and high color contrast to tactile elements like Braille for card differentiation.

Convego® SenseDot

These embossed bumps, applied to the card at the point of personalization help customers differentiate between different cards in their wallets – for example, a customer’s credit card might have a different pattern of bumps than their debit card.

Convego® YOU Biometric Card

Cards protected with biometric security remove the need for customers to use passwords, PINs, or a mobile device to authenticate their transactions.

Convego® YOU ClearView

With this service, banks can print the cardholder’s PAN, expiry, name, and CVV in large and high contrast print to make it easier to read and make payments, great for those that might struggle to read a smaller print or embossed detail.

Notch card

A revolution in card design, featuring a distinct crescent-shaped notch for effortless identification and orientation, enhancing the payment experience for visually impaired customers.

Digital payment advancements

Tailored, optimized digital payment solutions that emphasize user-friendly processes and heightened security through seamless biometric techniques in line with global standards.

Senior Wallet (powered by Netcetera)

A digital payment wallet solution specifically designed with older people’s potential needs in mind. A full-featured solution with specific enhancements to ensure maximum legibility and usability.

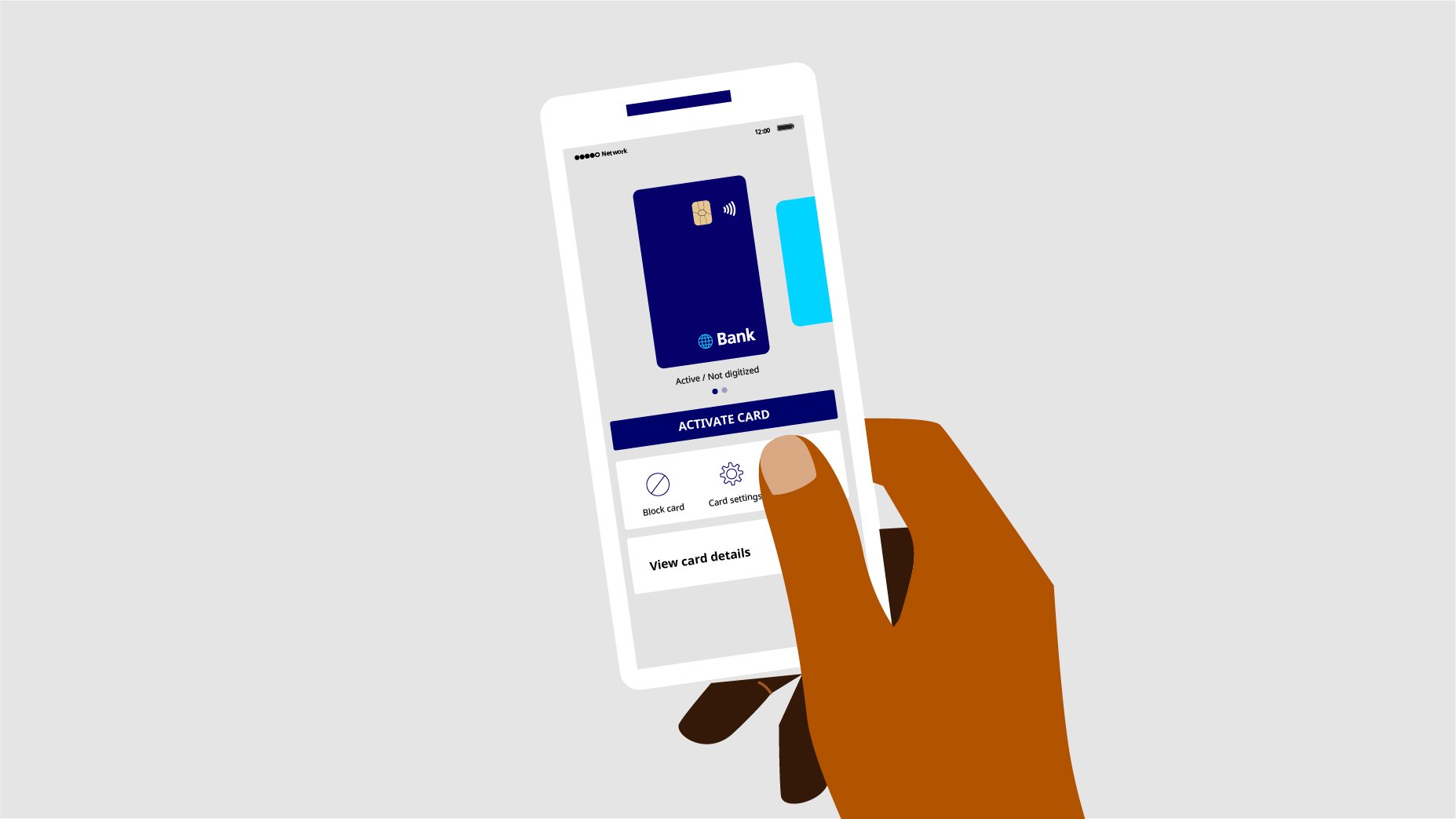

Convego® CloudPay HCE with G+D Assist

Convego® HCE with G+D assist allows banks/issuers to manage the digital payment experience and even provide capabilities such as audio confirmation of the payment amount before it is processed.

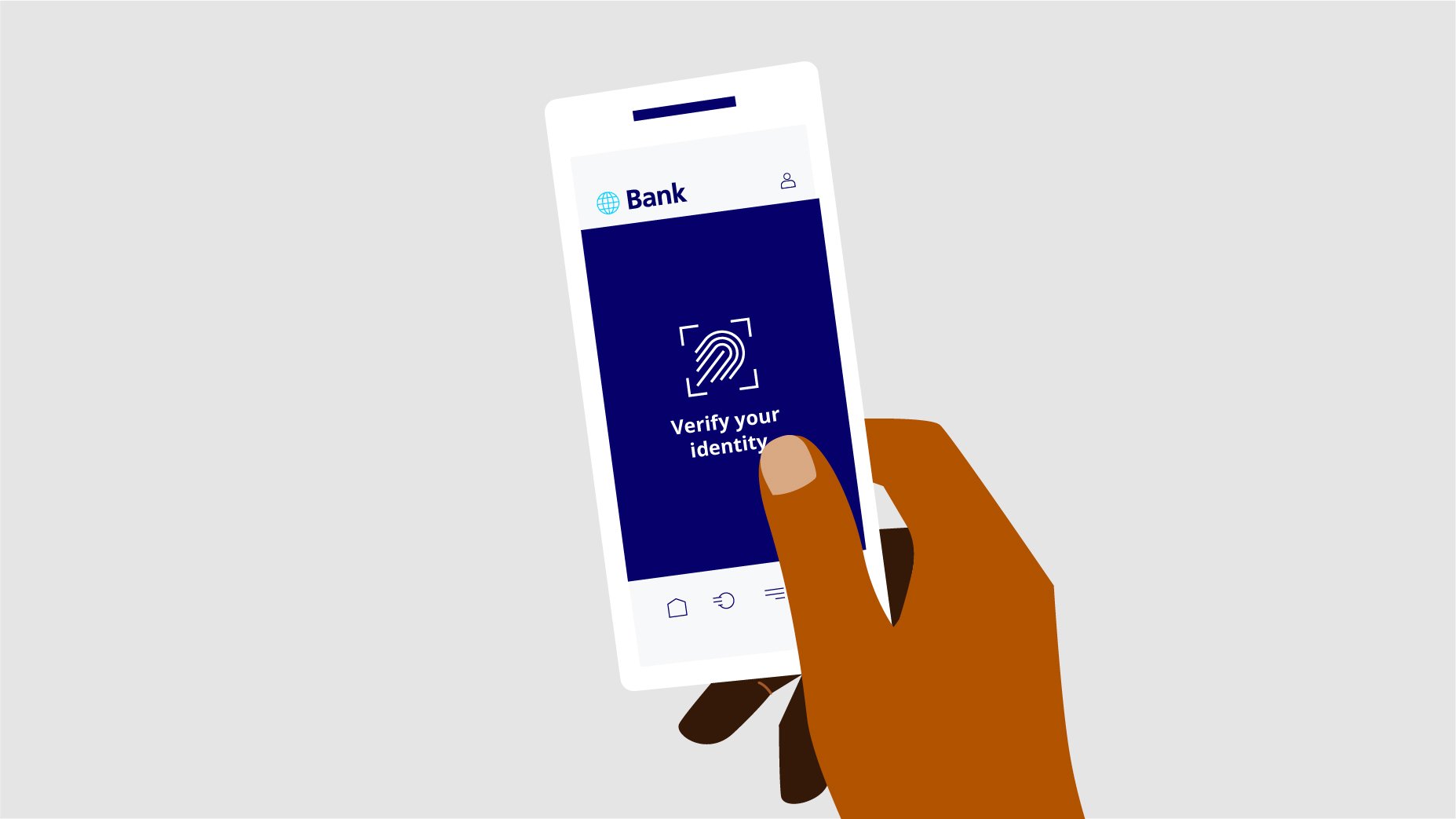

Convego® AUTH-U

Convego® AUTH-U is a highly secure, seamless, and biometric-based solution that enables digital payments to be authenticated without passwords or PINs.

Onboarding development

Prioritizing digital accessibility for those unable to visit physical branches, with initiatives such as remote onboarding solutions, QR-enabled audio content, and guided card activation processes.

Convego® Braille (card & mailer)

Your payment card can be accompanied by both the traditional carrier and – in braille format – a document that helps customers with visual impairments understand the information contained on the user’s payment card and mailer.

“Talk to me” Verbal Carrier & QR Codes

QR codes can be printed in your carrier letters and allow customers to access audio content – in multiple languages – which could be additional information, AR simulation or an audio version of the carrier content.

Inclusive language – your guide

The language we use to talk about accessibility issues can be extremely important. Download our guide to discussing accessibility, disability and impairment in an open and inclusive way!

Working towards accessibility for all – together

Collaboration in action

We are thrilled to announce our membership with Business Disability Forum (BDF), a leading player in the disability inclusion space. This partnership aligns perfectly with our mission to create more accessible payment and banking experiences for all. With BDF's extensive network of over 600 members and 64 partners, we are poised to accelerate our co-creation processes with banks and local communities, ensuring that no one is left behind in the financial landscape.

Together, we're paving the way for a more inclusive and accessible payment world.

Empower banking with AI sign language technology

Giesecke+Devrient is proud to partner with Signapse AI to transform accessibility in the banking and payment sectors for individuals with hearing loss. Discover our collaborative efforts to integrate AI-powered sign language technologies into banking & issuance services.

Check out more about Signpase AI!

Customise your payment card for different accessibility needs

.jpg?width=2000&height=1125&name=LABS_Website_Fast_track%20(1).jpg)

Convego Labs®

Get connected with G+D's innovation experts and work collaboratively to launch your unique payment card that can support specific accessibility needs of your customers, such as visual impairment, hearing impairment and more.

More Accessible Payments Workshop

Unlock the future of payments & banking: The More Accessible Payments Workshop in Munich

Dive into the forefront of banking innovation where inclusivity meets technology. Join us in shaping a future where financial services are accessible to all.

On March 13th, 2024, Giesecke+Devrient (G+D) and the International Bankers Forum presented the exclusive More Accessible Payments (MAP) Workshop. Hosted in the heart of Munich, this event is a landmark gathering of thought leaders and change-makers.

This is more than just a workshop – it's a unique opportunity to collaborate and co-create with experts from diverse sectors like banking, fintech, and PayTech, as well as NGO leaders and community advocates. Be a part of pioneering discussions and hands-on sessions that are set to redefine the standards of accessible banking.

More insights

More accessible payments for all

Whether in the workplace, in social environments, or in providing vital services such as banking and payments, accessibility is no longer an option – it is a fundamental right.

Explore how G+D and Microsoft think about accessibility

In this exclusive Spotlight interview, Microsoft’s Lead Accessibility Evangelist & Director, Hector Minto, and G+D’s Director of Managed Card Issuance, Thomas Götz, discuss the lessons banks can learn from Big Techs, and the importance of cross-industry collaboration in driving the accessibility agenda.