Making banking and payments fraud-smart

What more can banks do to fight fraud?

As banking becomes digitalized, there are increasing levels of fraud worldwide. Customers are becoming more alert to these fraud and phishing techniques – but criminals are evolving their approach. Fraud attempts are increasingly sophisticated, and even though most customers’ banking is protected by multi-factor authentication (MFA), this security is not a guarantee against successful attacks.

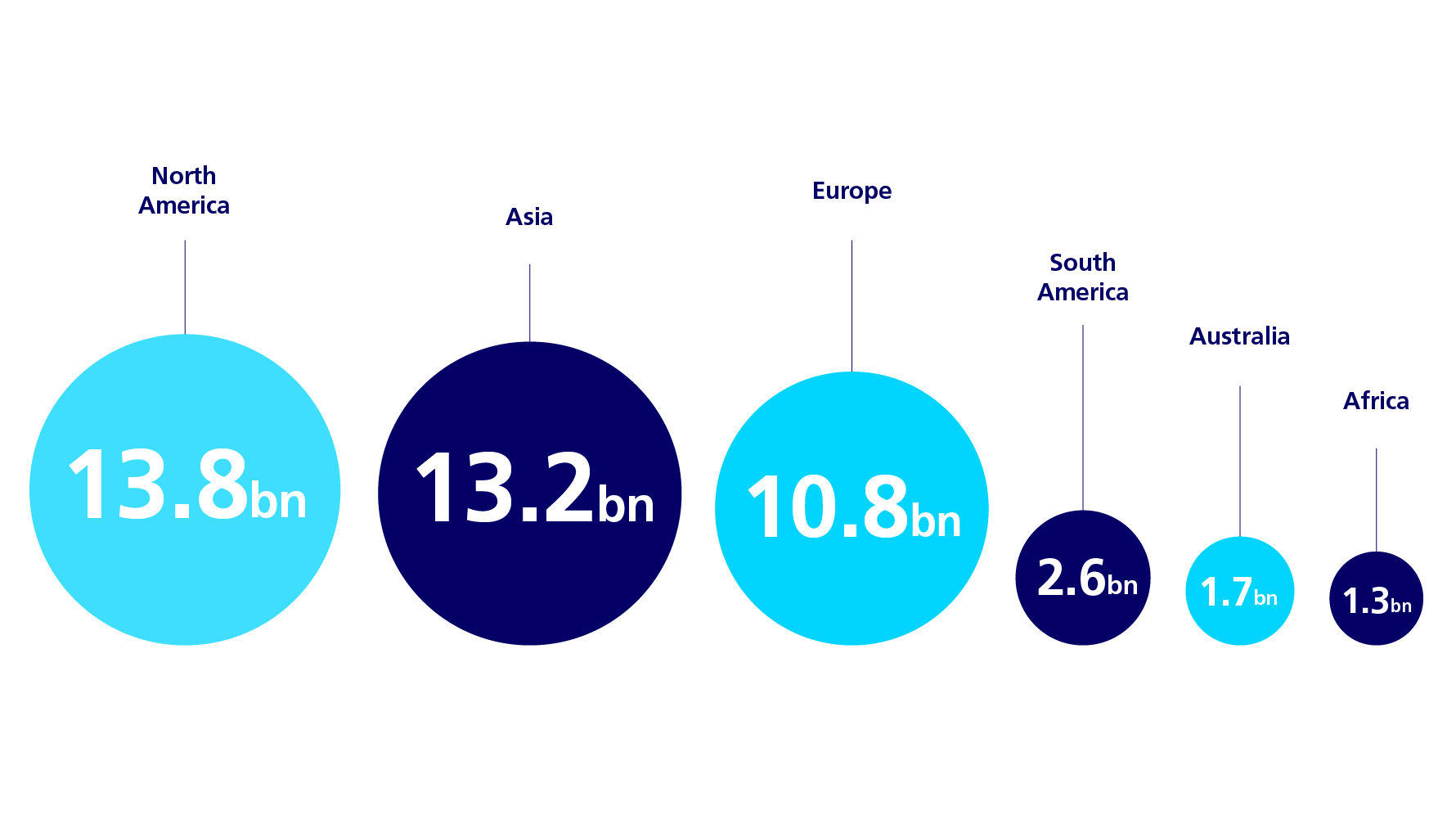

OTPs: One-time password or one that’s phishable

Even though multi-factor authentication through one-time passwords (OTPs) is more secure than traditional single-factor security, savvy fraudsters have figured out ways to overcome their protection like making your customers think the situation is extremely urgent.

Existing multi-factor authentication mechanisms are no longer cutting edge, leaving your customers open to risk. Here’s just one example of a scenario that proves relying on OTPs isn’t enough

The scenario shows:

Sophisticated crimes

Fraud is incredibly sophisticated and significantly increasing, putting customers and banks at risk.

OTPs are vulnerable

When authentication relies on elements like OTP, it leaves customers open to phishing and tracing, potentially compromising their accounts.

No

control

Banks have little to no control over the authentication mechanism.

Recent survey*, among a representative group of 500 online fraud victims, highlights:

44%

clicked too quickly, unknowingly paving the way for fraud.

55%

acknowledge that a little patience could have uncovered the deception.

48%

acted hastily, foregoing the due diligence to verify the situation.

* Source: Survey: Nearly half of online fraud due to clicking too fast, ABN AMRO, 2023

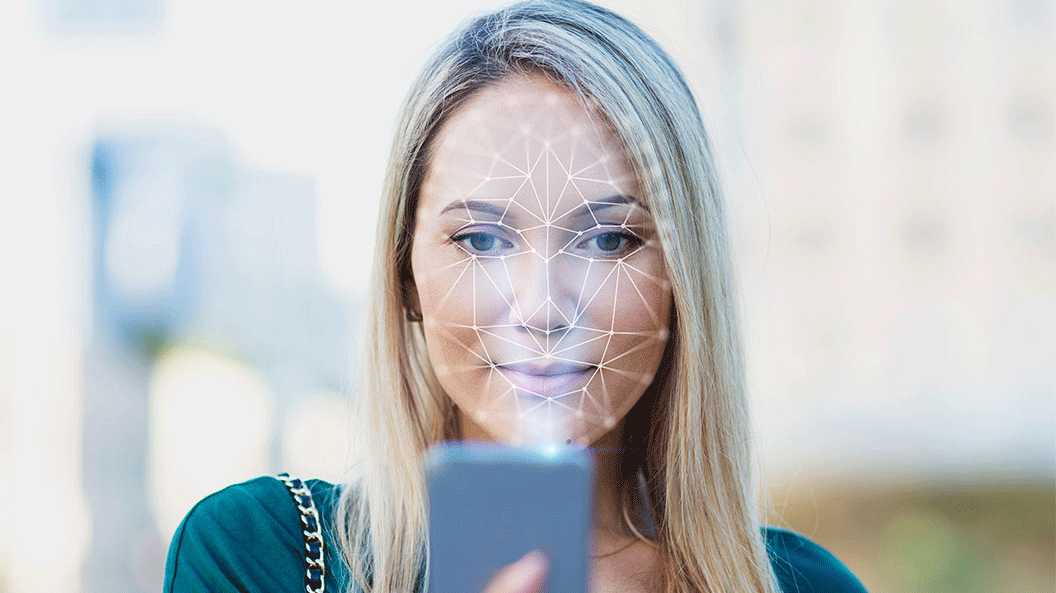

The impact of fraud:

8tn

is the predicted cost relating to cybercrime and fraud – globally.

84%

of organizations worldwide have been subjected to mobile phishing attacks at one time or another.

The non-financial cost of fraud

Authentication challenges

G+D has been recognized as a 'Luminary' in Authentication

Discover why we have been distinguished as a 'Luminary' in the authentication sector by Acuity Market Intelligence. Gain insights into the critical factors that set G+D apart in the industry. For an in-depth understanding, download their full report by clicking the link below.

Passkeys: The key to secure authentication experience

Customers demand a simple, secure, easy-to-navigate, and seamless authentication experience. One solution holds the answer – passwordless authentication through biometrics.

Imagine a future where 'something you have' (your device) and 'something you are' (your biometrics) seamlessly merge to create a secure, effortless authentication experience.

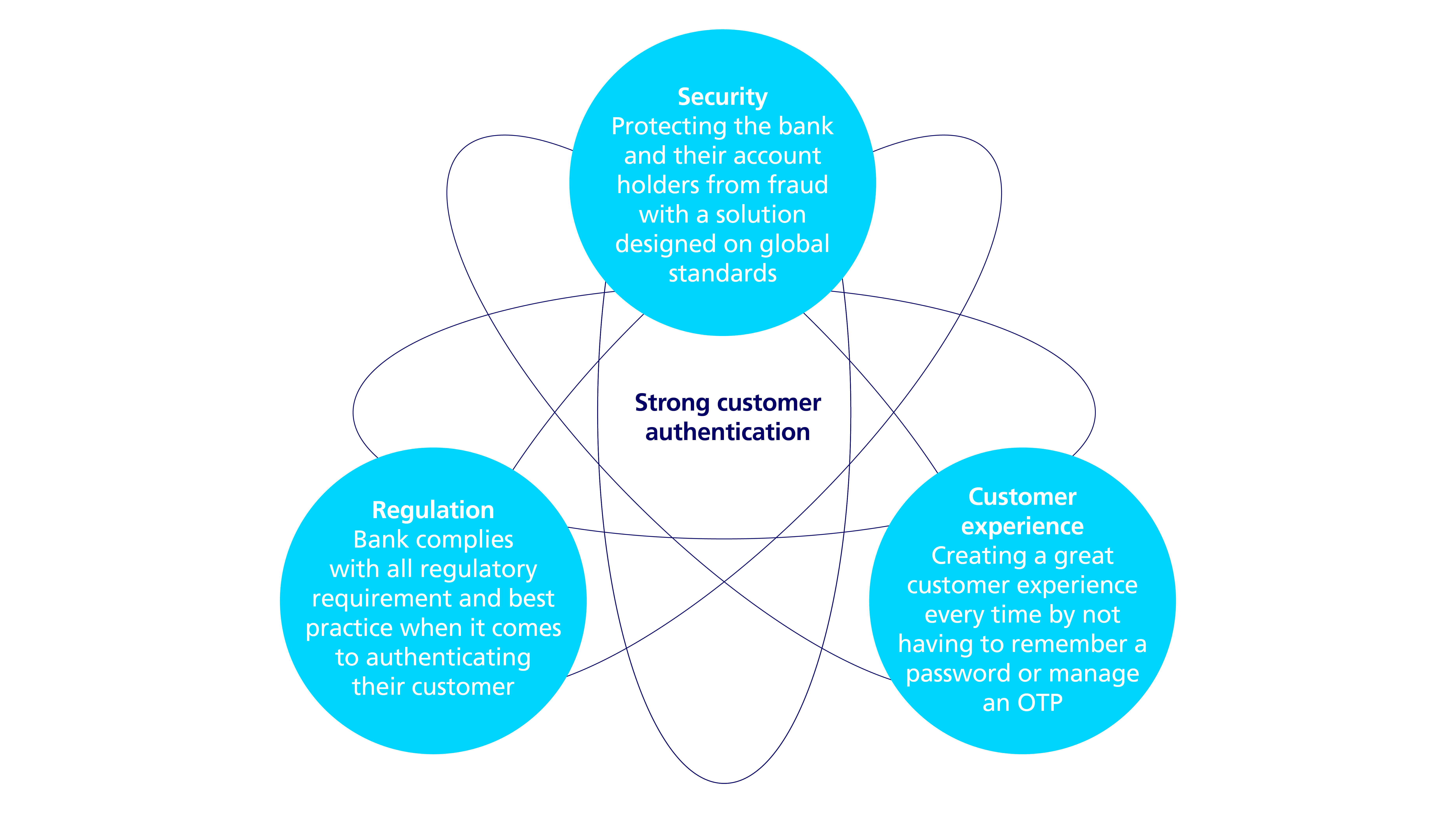

In a world where digital security is constantly evolving, financial institutions need to strike the perfect balance between security, compliance, and customer experience.

Outpace fraud with Passwordless Authentication

IDC's latest Info Snapshot reveals a growing trend towards FIDO-based biometric authentication. Download your copy to explore how to stay ahead of the fraudsters and optimize your customer authentication experience.

Your customers trust you to provide secure banking and payments experience.

Who can you trust to enable that security?

Get in touch

For over 170 years, as a global SecurityTech company, our mission has been to create innovative solutions safeguarding critical industrial sectors. Partnering with G+D allows banks and financial institutions to focus on their core business, free from constant concerns about safeguarding customers.