Reimagining digital asset custody for financial institutions' customers

Digital asset custody – reimagined!

Elevate your customer relationships with our modular digital asset solution

The digital assets market is surging, attracting a diverse customer base eager to build wealth and diversify investments. As regulatory frameworks solidify and an increasing number of financial institutions (FIs) explore this new asset class, integrating digital asset management into conventional banking services becomes not just an option but a strategic imperative to stay competitive.

Big implications for financial institutions

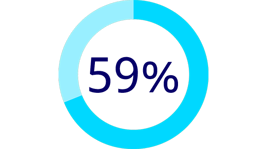

of consumers believe that crypto requires established financial institutions1 to achieve wide adoption

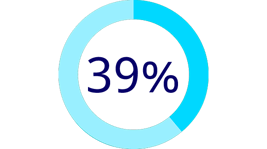

of crypto owners will switch to a bank that offers crypto products2 within 12 months

Financial institutions can unlock new growth opportunities by offering customers a secure and familiar digital asset management experience in a rapidly evolving market

Change is difficult

Financial institutions can run into several obstacles when trying to provide digital asset offering as part of its product suite:

Navigating unfamiliar terrain

Lack of expertise in the digital asset space

Addressing complex custody management issues

Steep user learning curve

How can financial institutions rise to the challenge?

Your customers are looking for new ways to protect their digital assets – which emphasize safety and convenience. To allay fears around existing recovery methods, financial institutions need to introduce a self-custody mechanism for their customers’ digital assets. With their strong foundations and trusted brands, existing financial institutions are well-placed to meet this growing need.

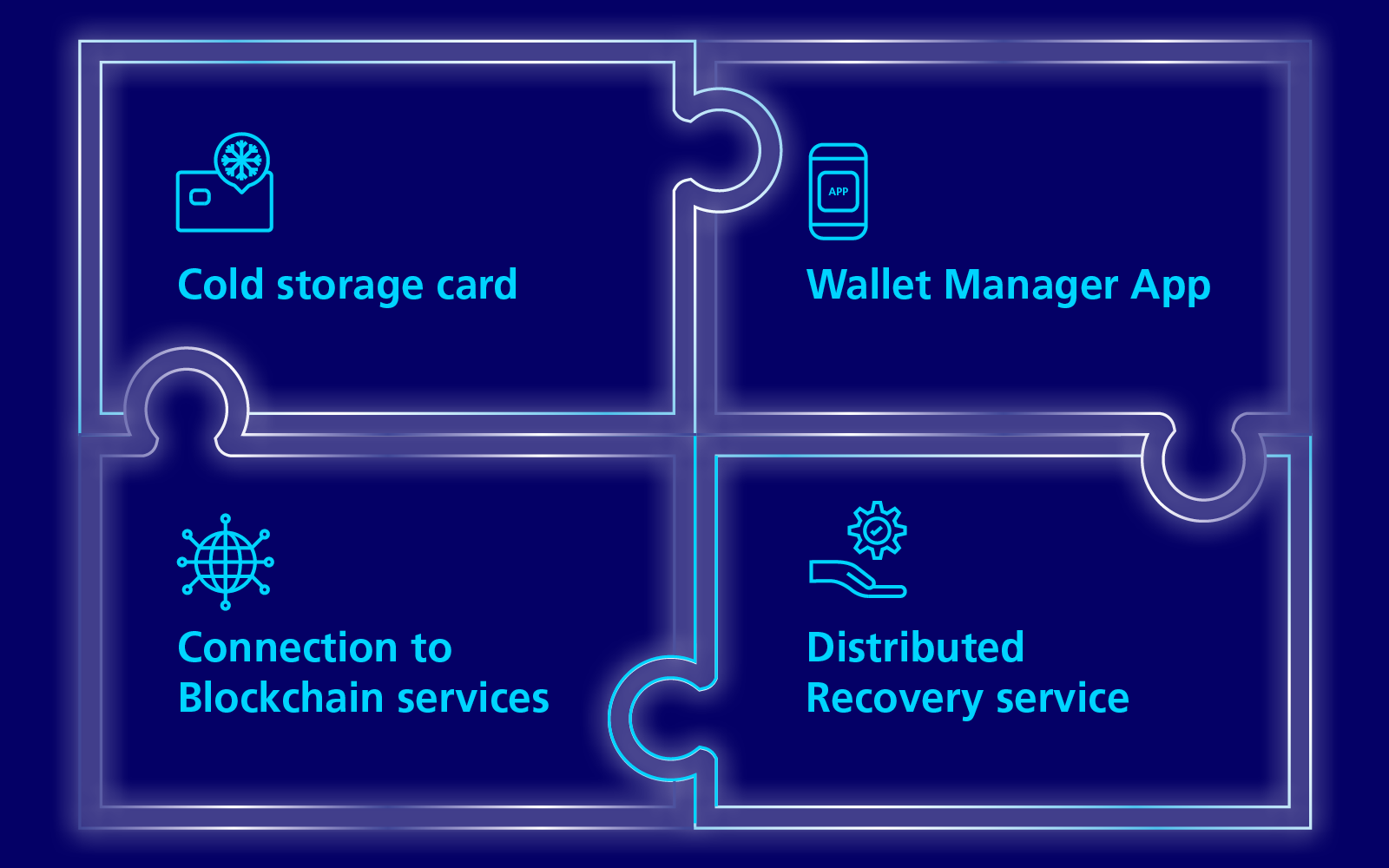

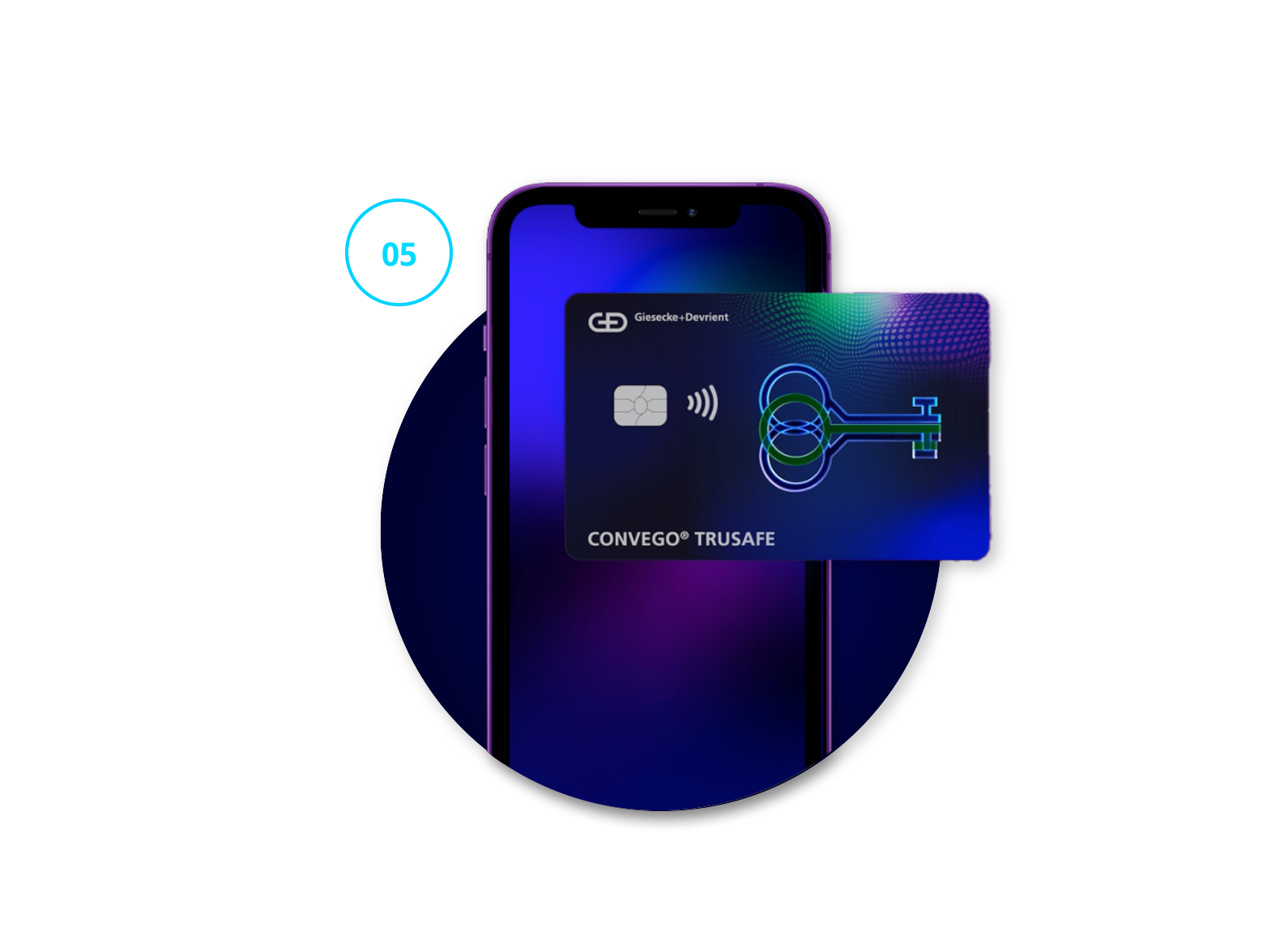

Imagine a solution where your customers can securely store their digital asset keys on their card and manage them effortlessly through a mobile app.

Introducing

Convego® TruSafe

Our solution empowers you to:

Benefits for financial institutions?

- Boost engagement with your wallet

- Add a new revenue stream

- Leverage the early-mover advantage

- Reduce costs and time to market

- Gain knowledge about blockchain and digital currencies

Benefits for

customers?

- Enhanced user experience for holding digital assets

- Ultimate self-custody of keys

- Peace of mind in recovery

What sets us apart?

A swift and seamless recovery mechanism

Our innovative recovery mechanism uses key sharding to securely restore your customers’ keys without compromising their self-custody. Regardless of the scenario, your customers always maintains full and irrevocable ownership of their digital assets.

Get started

Learn how Convego® TruSafe empowers financial institutions to foster trust and control in the management of digital assets, paving the way for widespread adoption.

Why G+D is the right partner for you?

Reliability

We put security and convenience at the center of our solutions for over 5000 banks and issuers worldwide.

TruSafe represents a natural evolution for us – from cash, to cards & digital payments, to digital assets

Robustness

We strategically align with prominent blockchain organizations to deliver comprehensive solutions.

Expertise

We’re experts in the digital assets space – with research and investment spanning CBDCs, blockchain, wallets, secure elements, hardened software, cryptography, and more.

Get in touch

Your customers trust you to provide secure banking and payments experience.

Who can you trust to enable that security?

For over 170 years, as a global SecurityTech company, our mission has been to create innovative solutions safeguarding critical industrial sectors.

Partnering with G+D allows financial institutions to focus on their core business, free from constant concerns about safeguarding customers.